tax on unrealized gains yellen

A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose. VIDEO 1521 1521 Howard Marks of Oaktree.

Democrats Terrible Idea Taxing Profits That Don T Exist

California long term capital gain rate 133.

. Speaking to CNN on Sunday the former Federal Reserve chair said the measures would target liquid assets held by extremely wealthy individuals. Is exploring plans to tax unrealized capital gains sparking fierce criticism on Crypto Twitter. NEW US.

That sounds good until you realize that 100000 increase was an unrealized gain. Treasury Secretary Janet Yellen announced on Sunday that a proposed tax on unrealized capital gains yes gains from investments that havent even been sold yet could help finance President Bidens new 2 trillion social spending. Yellen Describes How Proposed Billionaire Tax Would Work.

A Texas resident would see the following taxes. Thats tax on unrealised capital gains. Janet Yellen Bidens nominee for Treasury Secretary said she would consider taxing such unrealized gains to boost government revenues reported Reuters.

A business associate of mine always tells me Until youve sold your stock you havent made a dime Sell that one to Janet Yellen. President Biden Unveils Unrealized Capital Gains Tax for Billionaires. And if you dont pony up for Janet Yellens salary the government is coming for you.

Janet Yellen the Treasury Secretary in the Joe Biden administration has proposed taxing unrealised capital gains. Total long term capital gain rate 567. Instead of paying taxes when you finally sell your home or cash out your 401k or trade stock you would be taxed on the subjective made-up unrealized value gain right now.

Photo by Alex WongGetty Images Heres. Polis is a proponent of reducing the generous net operating loss deduction and taxing capital gains at the same rate as any other income. Federal long term capital gain rate 396 BidenYellen proposal v 20 today.

The tax would apply to all property which includes stocks real estate gold and even cryptocurrencies like bitcoin. If Yellen and the US. So if a stock goes from 100 to 150 a piece in a year but you havent sold it.

Capital gains tax is a tax on the profit that investors realize on the sale. Senior Democrats confirmed that a proposal to tax billionaires unrealized capital gains will likely be included in President Bidens 2 trillion spending packageTreasury Secretary Janet Yellen explained on CNN Sunday. A 2 drawdawn on your unrealized capital gains requires people to have set aside cash for that very tax purpose.

Since then many wealth managers from Howard Marks to Peter Mallouk as well as many others have argued that this. Treasury Secretary Janet Yellen has revealed that the US. Democrats have proposed partly funding some of their multitrillion-dollar spending plan with a tax on the unrealized capital gains of anyone who makes more than 100 million per.

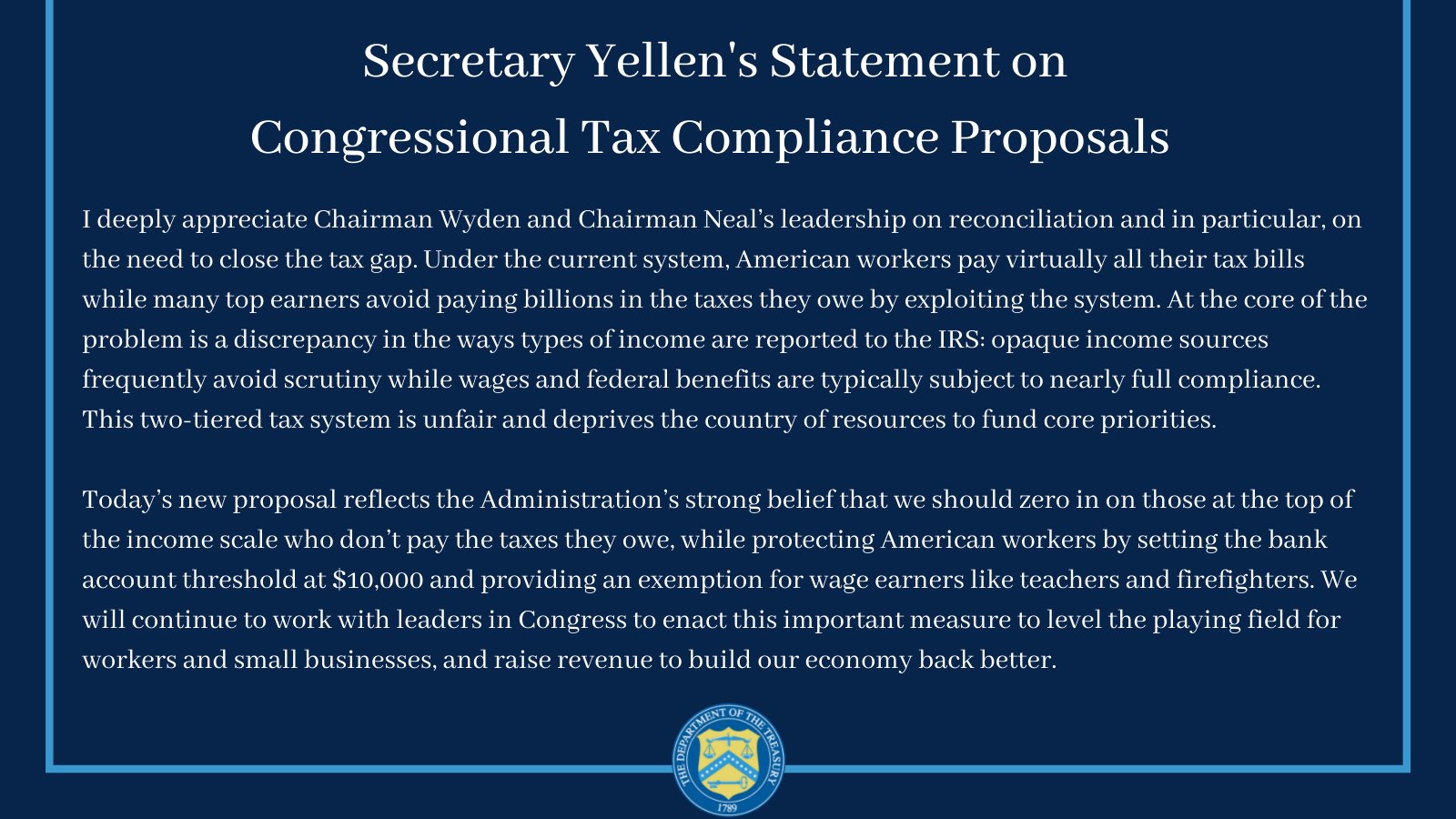

United States President Joe Bidens Treasury secretary nominee Janet Yellen has once again become a topic of discussion in the Cryptoverse - this time over her comments suggesting she may look to tax of unrealized gains. Its not a wealth tax but a tax on unrealized capital gains of exceptionally wealthy individuals Treasury Secretary Janet Yellen was at pains to explain. Treasury Secretary Janet Yellen explained on CNN Sunday that the proposal raised by Sen.

Federal long term capital gain rate 396 BidenYellen proposal v 20 today. Earlier in 2021 Yellen proposed taxing unrealized capital gains to boost US. At a time when there.

Cryptocurrency is not looked at by the IRS as currency but rather as property. The plan will be included in the Democrats US 2 trillion reconciliation bill. The 78th United States secretary of the treasury Janet Yellen told CNNs State of the Union on Sunday that US.

And this has led some to question if the US is demonstrating a sign of what is to come in other countries that are printing fiat money at an. Treasury Secretary Yellen proposes a tax on unrealized capital gains to finance Bidens Build Back Better plans. You may still have to pay a tax on that 50 a share where you havent made a profit yet.

Yellen had first proposed the tax on unrealised capital gains in February 2021. Government coffers during a virtual conference hosted by The New York Times. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in.

Ron Wyden D-Oregon would impose an annual. It goes against the concept of taxing income because thats a tax on generated cash flow whereas there is no generated cashflow in. The Treasury gig hasnt been.

Lawmakers are considering taxing unrealized capital gains. 2 hours agoThe answer is relatively simple considering the tax code is estimated to be at least 70000 pages. Yellen told Jake Tapper I think whats under consideration is a proposal that Senator Wyden and the Senate Finance Committee have been looking at that would impose a tax on unrealized.

Congress have their way wealthy investors may be taxed on those unrealized gains the price appreciation of their assets. An unrealized gain is when something you own gains value but you dont sell it like your house or your retirement fund. Secretary Janet Yellen has been discussing in various media the Biden administration is now revealing an unrealized capital gains tax from stocks and bonds.

Heres what big fund managers have to say about Yellens proposal. National Investment Income Tax 38. Secretary of the Treasury Janet Yellen speaks during a daily news briefing at the White House.

BeInCrypto The United States Treasury Secretary Janet Yellen has announced the proposal of a new tax that could hit unrealized capital gains. Net operating loss deductions and the reduced tax rate 15 to 20 on capital gains. Disclosetv disclosetv October 24 2021.

Yellen Describes How Proposed Billionaire Tax Would Work Including Yellen S Proposed Tax On Unrealized Gains In The Stock And Real Estate Market R Wallstreetbets

Secretary Janet Yellen On Twitter Today S Congressional Tax Compliance Proposal Reflects The Administration S Strong Belief That We Should Zero In On Those At The Top Of The Income Scale Who Don T Pay

Best Argument Against Unrealized Capital Gains Tax Janet Yellen Capital Gains Tax Youtube

Does Treasury Secretary Yellen Really Want Unrealized Capital Gains To Be Treated As Income Swfi

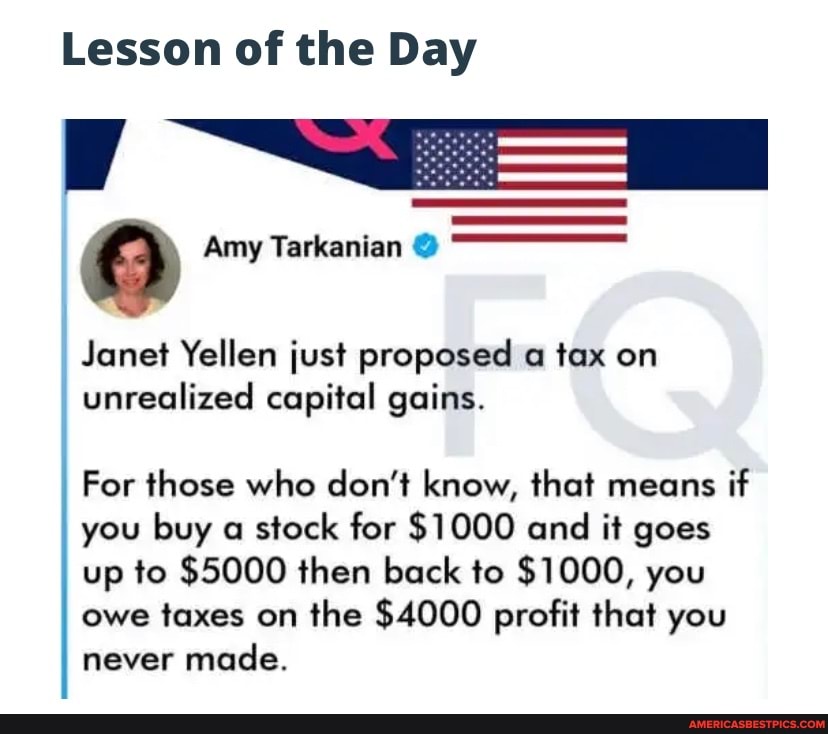

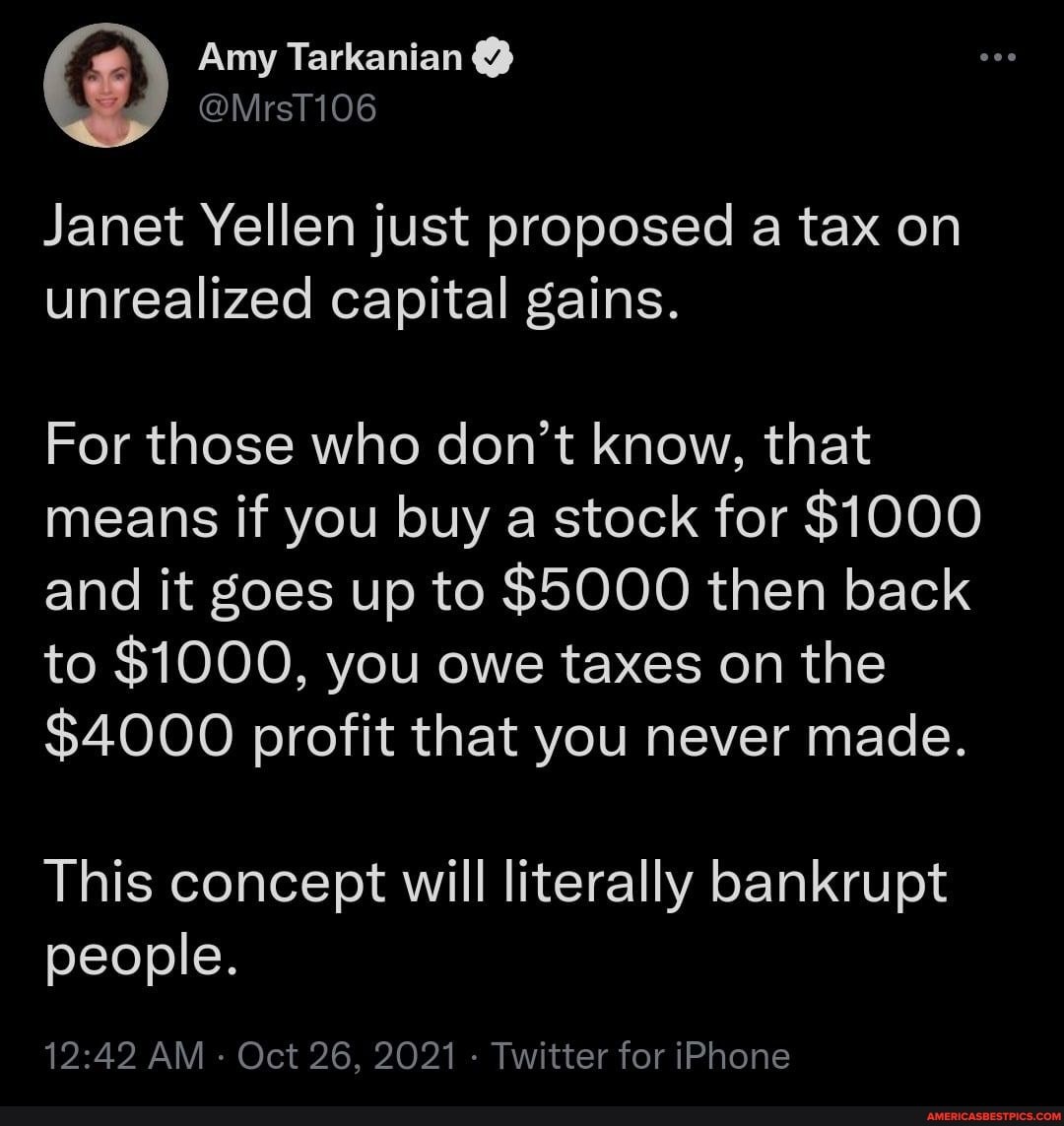

Lesson Of The Day Amy Tarkanian Janet Yellen Just Proposed A Tax On Unrealized Capital Gains

Tax On Unrealized Capital Gains Proposal By Janet Yellen Exponential Age Youtube

Janet Yellen Favors Higher Company Tax Signals Capital Gains Worth A Look Business Standard News

Yellen Argues Capital Gains Hike From April 2021 Not Retroactive

Janet Yellen S Idea To Tax Unrealized Capital Gains R Wallstreetbets

Nancy Pelosi Says A Wealth Tax On Billionaires Unrealized Gains Is On The Way Mish Talk Global Economic Trend Analysis

Bloombergquint On Twitter Yes Taxation Of Unrealised Stock Market Gains Seems Unusual But It Is Already Embedded In The System Argues Shankkaraiyar Calling For A One Time Tax On Billionaires He Points To

Us Lawmakers Float Tax On Billionaires Unrealised Capital Gains The Market Herald

Practical Memes Key Points Taxing Unrealized Capital Gains Is Not Practical And Will Hurt Sentiment Among Investors Said Howard Marks Co Chairman And Co Founder Of Oaktree Capital Unrealized Capital Gains

Investing Com S Tweet Yellen To Propose Capital Gains Tax As High As 80 For Crypto Trading Heard On Street Btc Eth Xrp Doge Trendsmap

No U S Won T Tax Your Unrealized Capital Gains Alexandria

Janet Yellen Proposes Insane Capital Gains Tax On Bitcoin Youtube

Treasury Secretary Janet Yellen Says Taxing Unrealized Capital Gains Is A Possibility Youtube

Janet Yellen It S Not A Wealth Tax It S A Tax On Unrealized Capital Gains Bit Haw

Janet Yellen Just Proposed A Tax On Unrealized Capital Gains For Those Who Don T Know