can you look up a tax exempt certificate

Form 990 Series Returns. There are different types of exempt.

Florida Tax Exemption Forms Aviall Support Center For Best Resale Certificate Request Letter Template Letter Templates Lettering Free Gift Certificate Template

Method 1 Obtain a copy of your customers current Annual Resale CertificateYou can accept paper or electronic copies.

. An IRS agent will look up an entitys status for you if. Automatic Revocation of Exemption List. Certain sales are always exempt from tax.

This means a purchaser does not need an exemption certificate to make purchases of these items or services. Form 990-N e-Postcard Pub. You can also search for information about an organizations tax-exempt status and filings.

The registration number is an eleven digit number assigned by the Comptroller that begins currently with a 1 or a 3. Tap Tax Exempt Certificates to use and manage your certificates. An exemption certificate is the form presented by an exempt organization or individual to the seller when making a tax-exempt purchase.

As a seller you must document each tax-exempt sale for resale using one of the following methods. About the Tax Exempt Organization Search Tool. Form ST16 Application for Nonprofit Exempt Status-Sales Tax.

You may call in and verify the status based on the information provided in Form F0003. Even when the purchaser is a government agency school or other exempt entity the seller should require the purchaser to complete and sign a Sales Tax Exemption Certificate. Form 990-N e-Postcard Pub.

You may also call in and verify the status based on the information provided in Form 211. The purchaser can give a single purchase certificate for just one transaction or a blanket certificate that applies to future purchases of qualifying exempt items. Payment for the purchase must be made with the governmental entitys funds.

Statewide group organizations might have one listing with All Branches as the city rather than a separate listing for each local chapter. Many regulations include examples of exemption certificates that a purchaser might issue to a seller. Exemption certificates do not expire unless the information on the certificate changes.

You can check an organizations eligibility to receive tax-deductible charitable contributions Pub 78 Data. Another way to check the tax-exempt status of a company or organization is to call the IRS directly at 1-877-829-5500. However a seller is relieved of any responsibility for collection or payment of the tax if the seller obtains from the purchaser within 90 days after the date of the sale a fully completed exemption certificate which indicates that the purchaser will use the product or service in a manner that is exempt from Wisconsin sales and use tax.

Exemption Certificate Enter your Sales or Use Tax Registration number and the Exemption Certificate number you wish to verify. Exemptions are based on the customer making the purchase and always require documentation. If you are a reseller.

Different purchasers may be granted exemptions under a states statutes. However we recommend updating exemption certificates every three to four years. An NTTC is the only documentation TRD can legally accept as documentation for certain deductions taken by sellers or lessors.

You will need to present this certificate to the vendor from whom you are making the exempt purchase - it is up to the vendor to verify that you are indeed qualified to make a tax-exempt. If you intend to use the supplies yourself you cannot use a resale exemption certificate and the distributor must collect sales tax from you. Searching by registration number will result in you finding data specific to that number.

Revenue Minnesota Department of. When payment is made with the personal funds of an authorized representative the purchase is subject to tax even if the representative is subsequently. The online search tool allows you to search for an organizations tax exempt status and filings in the following data bases.

Wyoming Online verification is not available. Search for an existing registration number. AgTimber Number Search Agricultural Timber Exemption Application.

You may select a different method to document each sale for resale. It is important to read the regulations to determine whether the sample exemption certificates apply to your transactions. All jobs Find your new job today.

Job Listings From Thousands of Websites in One Simple Search. Automatic Revocation of Exemption List. This page includes links to the sample exemption certificates that are included in regulations and to the regulations themselves.

Provide a copy of the Florida Consumers Certificate of Exemption to the selling dealer to make tax exempt purchases or leases in Florida. The Minnesota Department of. Form 990 Series Returns.

Fully complete the information in tabs 1 through 4 before providing your vendor with an electronic copy of the certificate or a printed and signed copy. Search and obtain online verification of nonprofit and other types of organizations that hold state tax exemption from Sales and Use Tax Franchise Tax and Hotel Occupancy Tax. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making sales-tax-free purchases.

If you are a reseller using NTTCs may exempt you from paying gross receipts taxes on qualified purchases. Paul MN 55146 Phone. Account or with a credit card set up the same way.

From here you can. Use certificate during a purchase by selecting the one you want to use and tapping Display Barcode. Tap Manage Certificates to add edit or delete your tax exempt certificates.

Iowa Sales Tax Exemption Certificates. You may use the electronic certificate S-211E to claim an exemption from Wisconsin state county baseball stadium local exposition and premier resort sales or use taxes. Wisconsin Select Look up account number and filing frequency and enter all the required information.

Search by Registration Number. Maintain copies of the certificates paper or electronic for three years.

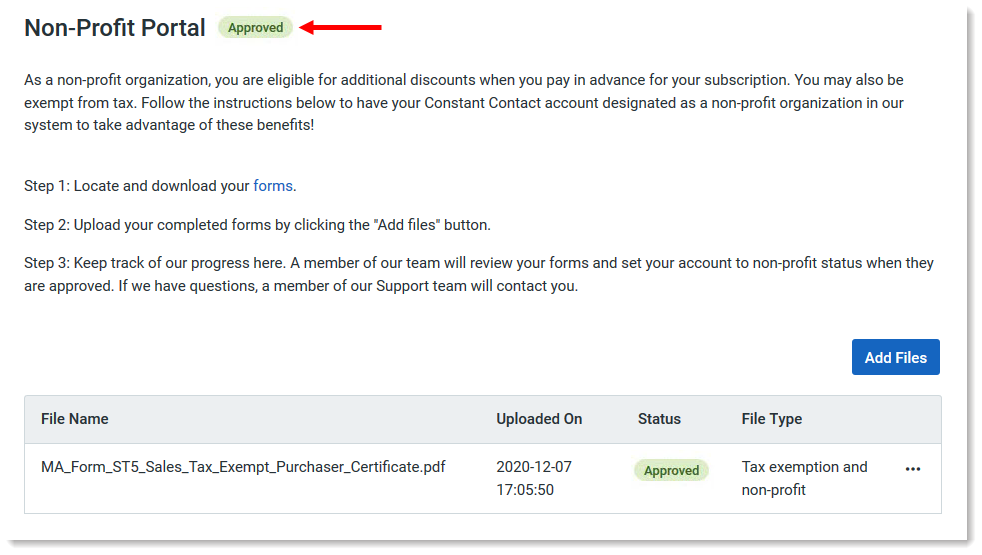

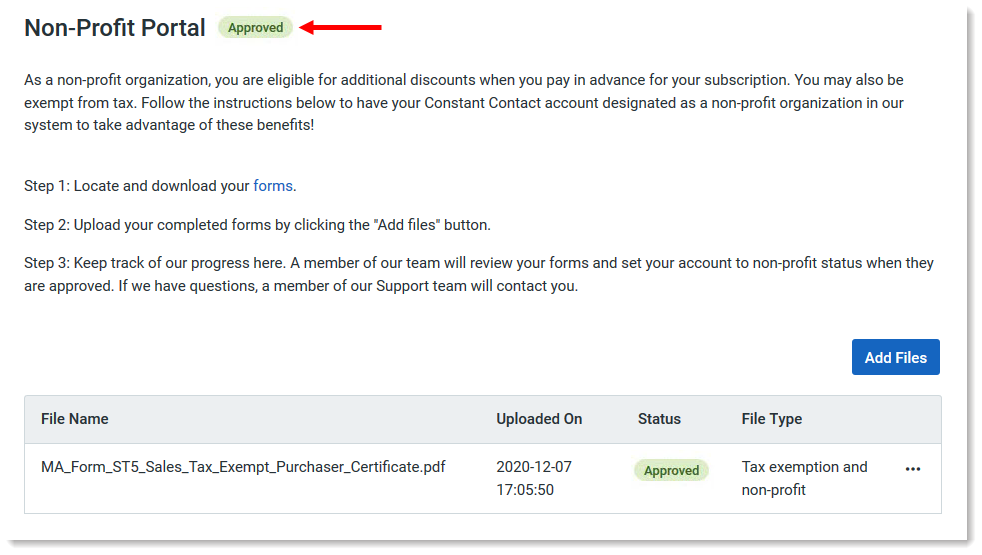

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

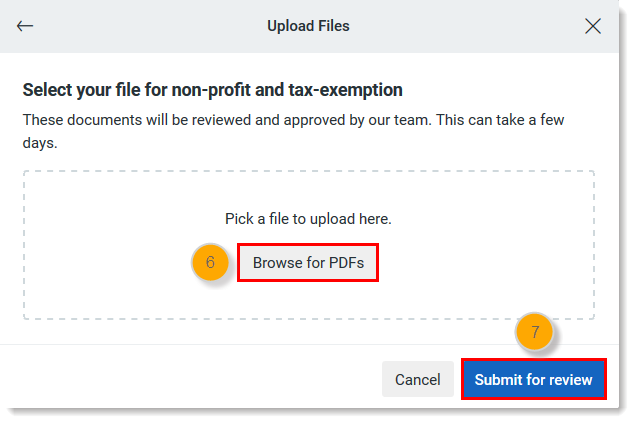

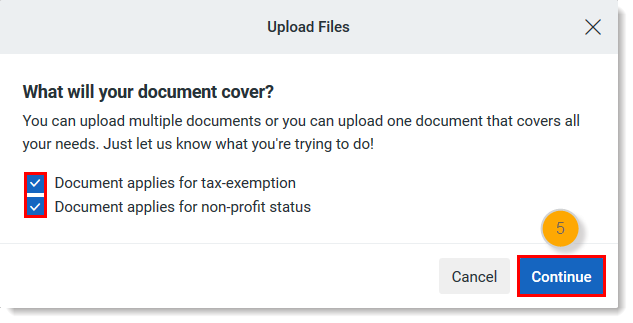

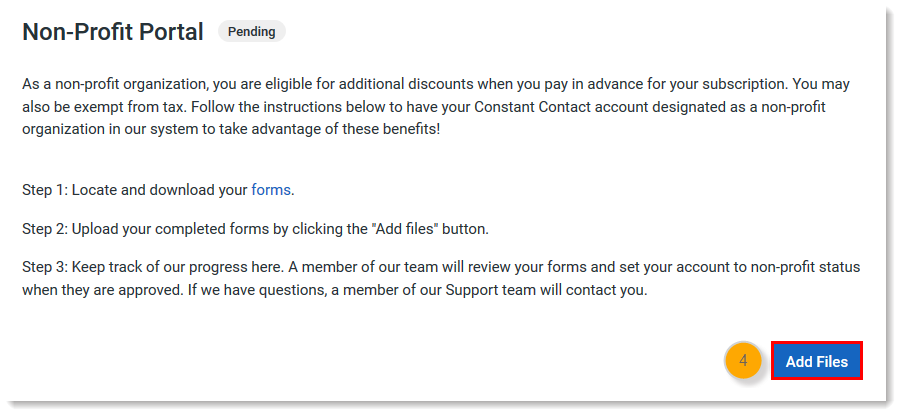

How To Submit Documentation For Sales Tax Exemption Help Center

Certificate Of Indian Status Identity Cards

Sample Letter Requesting Sales Tax Exemption Certificate Lera Mera Regarding Resale Certificate Re Literal Equations Cover Letter Template Cover Letter Example

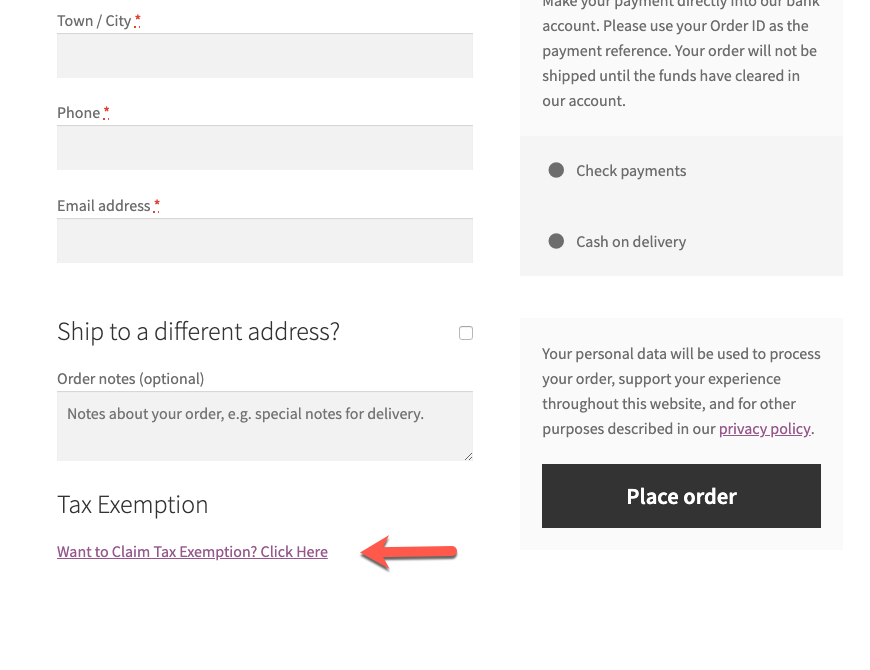

Woocommerce Tax Exempt Customer Role Exemption Plugin

Sales Tax And Tax Exemption Newegg Knowledge Base

Certificate Of Indian Status Identity Cards

What Is An Exemption Certificate And Who Can Use One Sales Tax Institute

Do I Have To Pay Sales Tax What If I Am Tax Exempt Techsmith Support

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption

Dor Foreign Diplomat Tax Exemption Cards

Tax Collection And Documentation Requirements For Nonprofits And Tax Exemption